how much taxes are taken out of a paycheck in ky

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. What percentage of my paycheck is withheld for federal tax.

Midyear Brings Federal State Changes For Payroll Professionals

For a single filer the first 9875 you earn is taxed at 10.

. You can deduct the most common personal deductions to lower your. Your employer then matches that contribution. Social Security and Medicare taxes will also come out of each paycheck.

Every pay period your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. How do I calculate the percentage of taxes taken out of my paycheck. These are contributions that you make before any taxes are withheld from your paycheck.

Colorado tax year starts from July 01. Every pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. Maximum Tax Rate for 2021 is 631 percent.

The income tax is a flat rate of 5. If you are self-employed you are responsible for paying the full 29 in Medicare taxes and 124 in Social Security taxes yourself. Because tax bills have been delayed into 2022 she says she and her.

You pay unemployment tax on the first 9000 that each employee earns during the calendar year. Luckily there is a deduction to help you pay this high self. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income.

Only the very last 1475 you earned. The Kentucky paycheck calculator will calculate the amount of taxes taken out of your paycheck. Minimum Tax Rate for 2021 is 031 percent.

If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar. Kentucky tax year starts. The income tax is a flat rate of 455.

These taxes are withheld in accordance with the Federal Insurance Contributions Act FICA so youll hear them. Your employer will match that by. Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for.

For 2022 the limit for 401 k plans is 20500. Has state-level standard deduction. No state payroll tax.

In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000. No standard deductions and exemptions. In the 1000 bonus example 1000 x 125 1250.

Medicare tax which is 145 of each employees taxable wages up to 200000 for the year. Kentucky Tax Brackets for Tax. The federal income tax has seven tax rates for 2020.

Employers also have to pay a matching 62 tax up to the wage limit. No state-level payroll tax. The IRS has already sent out more than 156 million third stimulus checks worth approximately 372 billion.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. 10 percent 12 percent 22 percent 24 percent 32 percent 35.

State Individual Income Tax Rates And Brackets Tax Foundation

How To Do Payroll In Kentucky What Employers Need To Know

/cloudfront-us-east-1.images.arcpublishing.com/gray/JPSPIL6PJBDHXMXVJMCW6Q35JM.bmp)

Ky Awarded More Than 3m In Federal Funding For New Transit Vehicles

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

State W 4 Form Detailed Withholding Forms By State Chart

Can I Get A Tax Refund If No Fed Taxes Were Taken Out Of My Paycheck During The Year

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

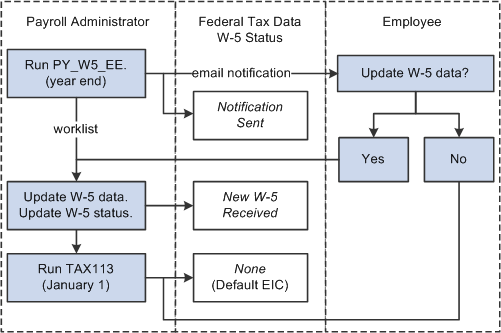

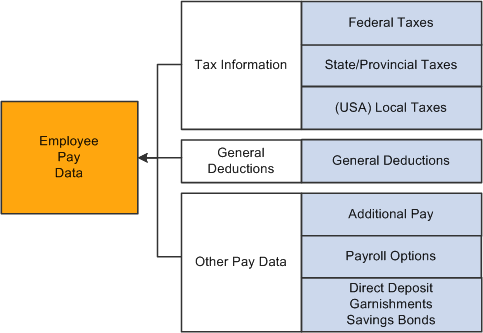

Peoplesoft Payroll For North America 9 1 Peoplebook

Paycheck Taxes Federal State Local Withholding H R Block

2022 Federal State Payroll Tax Rates For Employers

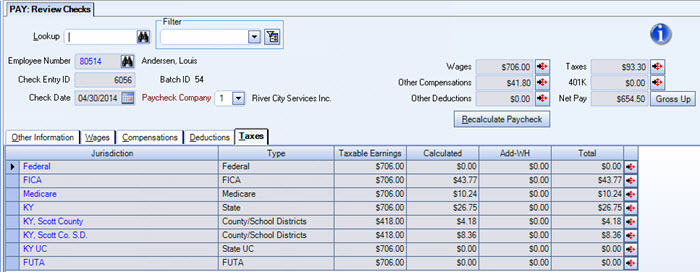

Kentucky County School District Taxes

Paycheck Tax Withholding Calculator For W 4 Tax Planning

State Withholding Form H R Block

The General Assembly Must Resist An Expensive Double Dip Tax Break And Instead Provide Targeted Aid To Businesses That Really Need Help Kentucky Center For Economic Policy

How Much Taxes Are Withheld Out Of A Paycheck In Kentucky Sapling

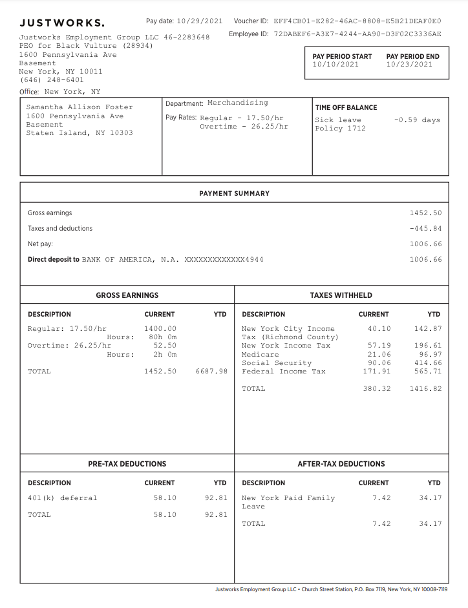

Questions About My Paycheck Justworks Help Center